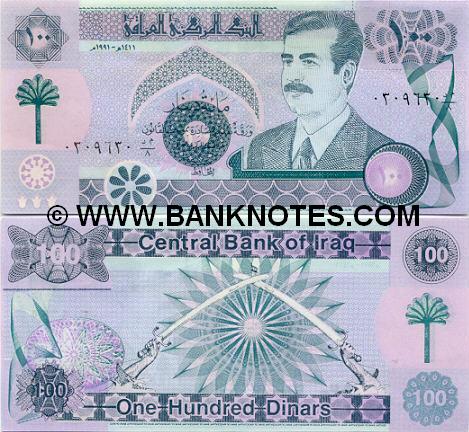

Dinar is the currency of Iraq, a predominantly Muslim country, and is issued by its Central Bank. Once a strong dinar, it was first circulated in the county in 1932 in subdivision of 1,000 files or coins to replace the Indian rupee that was the official currency since the end of the First World War. The strength of the Iraqi dinar currency came in the late 1950s when the then exchange rate was between US$2.8 and US$3.00 to a dinar.

The Iraqi dinar currency, however, devalued quickly as a result of excessive government printing of new banknotes and the sanctions on the country by the international community with the United States at the helm. That was after 1991 or the second Gulf War when the currency was replaced with the new dinar. In 2004, the new 25, 50 and 100 dinar coins were withdrawn from circulation shortly after being introduced because of their unpopularity among the Iraqis. Once a strong dinar, it consistently lost value at about 30% per year. As of the early months of 2013, the Iraqi dinar currency was valued at 0.00086 against the US dollar or 0.00056 to the British pound and 0.00065 to a Euro dollar.

The Iraqi dinar currency, however, devalued quickly as a result of excessive government printing of new banknotes and the sanctions on the country by the international community with the United States at the helm. That was after 1991 or the second Gulf War when the currency was replaced with the new dinar. In 2004, the new 25, 50 and 100 dinar coins were withdrawn from circulation shortly after being introduced because of their unpopularity among the Iraqis. Once a strong dinar, it consistently lost value at about 30% per year. As of the early months of 2013, the Iraqi dinar currency was valued at 0.00086 against the US dollar or 0.00056 to the British pound and 0.00065 to a Euro dollar.

Dinar Currency deals with the Iraqi dinar for more than four years now. This company provides reliable and safe means for one to acquire the dinar today and exchange it in the future. It says that the new currency that was once a strong dinar has enabled the country’s Central Bank and the country as a whole to build a new but sound national fiscal policy that works for the overall wheel. This policy must be designed to encourage investment both foreign and local in the infrastructure of the country.

Dinar Currency deals with the Iraqi dinar for more than four years now. This company provides reliable and safe means for one to acquire the dinar today and exchange it in the future. It says that the new currency that was once a strong dinar has enabled the country’s Central Bank and the country as a whole to build a new but sound national fiscal policy that works for the overall wheel. This policy must be designed to encourage investment both foreign and local in the infrastructure of the country.